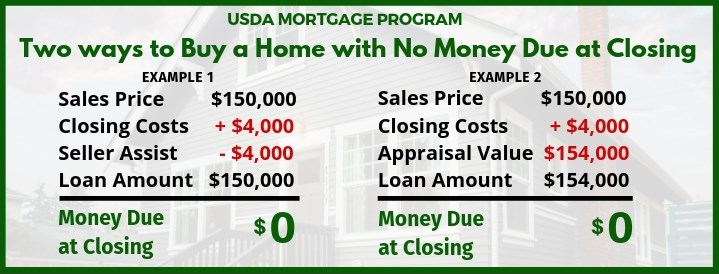

USDA Loans allow homebuyers to purchase a home in Gilbertsville, Pennsylvania with no down payment and often with no money due at closing.

Ok, great… how do I qualify for a USDA loan?

There are three components to qualifying for a USDA loan…

1) The Home

2) Your Income

3) Your Credit

What kind of home can qualify for a USDA loan?

The USDA has restrictions on property location and property type.

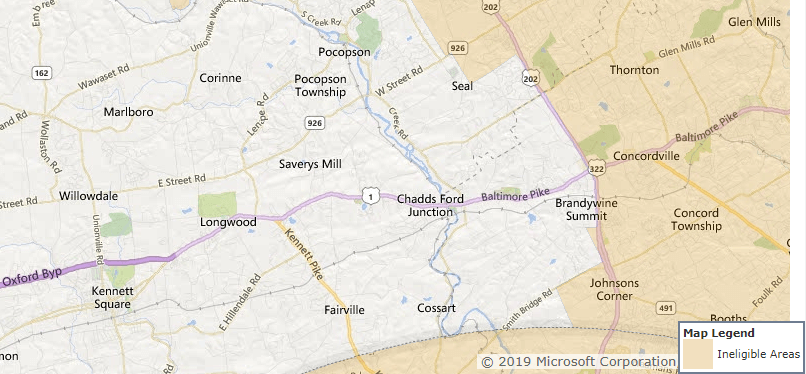

USDA Property Location

All homes in Gilbertsville, Pennsylvania are geographically eligible for a USDA Loan. The USDA has no location restrictions in Gilbertsville.

USDA Property Type

The USDA allows loans for Single Family Residences, eligible Condos, Manufactured homes, and Modular homes. The USDA requires that the home be “move in ready”. This is not a program for buying a “fixer upper”.

What type of Income is needed to qualify for a USDA Loan?

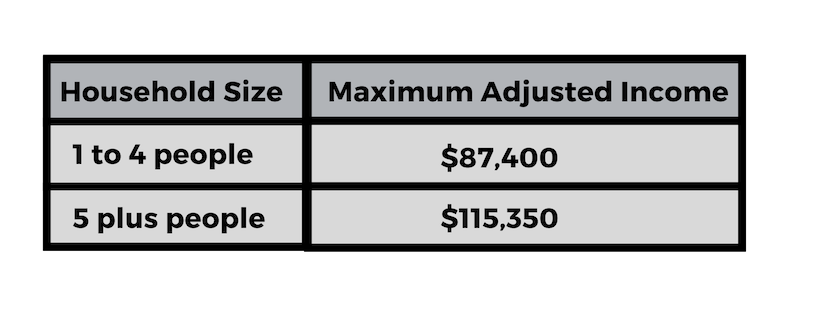

The USDA has maximum income limits for each Pennsylvania County. All of Montgomery County, including Gilbertsville, has the following income limits...